LA’s Staples Center to be renamed after crypto.com firm

Facebook announce their own ‘crypto’ name of Libra

https://www.bbc.com/news/business-48664253

To us – Cheap fake crypto to rival PayPal. To others – Mainstream adoption of crypto!

… hold onto your hats for a Bitcoin price surge!!

The pros and cons of Bitcoin

A now deleted reddit post (hence the webpage archive site, which might be flagged as dodgy, but this is defo worth a read!). The post and savage take-down of the top response tell you all you need to know!!

Quoted here:

“Hello, fellow Bitcoiners.

- 1) easy to use and understand by everyone

- 2) tamperproof such that it resists corruption of the original signal

- 3) neglegible in overhead costs

Response here:

A currency, the manifestation of money, is valuable when it does a good job of transferring the aforementioned data by being: 1) easy to use and understand by everyone 2) tamperproof such that it resists corruption of the original signal 3) neglegible in overhead costs

- Easy to use and understand by everyone – Why would you even set yourself up for this? “What is Bitcoin” “how does Bitcoin work” “How do I get a bitcoin” These are some of the most asked questions on the internet because nobody can grok Bitcoin on the first try, and even when they do, it’s not clear to them how they can “buy in”.

- Tamperproof such that it resists corruption of the original signal – While at first bluff this is true, tamperproof is really just one element of a larger desire that malicious third parties can’t change the debt record in their favor. From a purely technical standpoint Bitcoin should be resistant to this, but in practice, the number of coins lost to negligent storage, Wallet exploits, etc. puts this point squarely against BTC. I am much, MUCH less concerned that my US bank account will disappear due to some technical trapdoor, or compromised because somebody hacked into the computer systems at my credit union.

- Negligible in overhead costs – Bitcoin is ludicrously expensive to transact in, and circumventing this via, e.g. the Lightning network, necessarily involves tradeoffs against other technical qualities that you will doubtless be counting for Bitcoin elsewhere.

- Medium of exchange – worthless. Nobody wants to buy pizzas with Bitcoin, because it is by and large considered some kind of investment. I love the irony that people don’t want to spend their bitcoin to buy things because they’re convinced that it’s so incredibly useful to buy things – so much so that it will one day net them millions of… dollars? No wait, not that!

- It is completely untrustworthy as a store of value – putting money into Bitcoin is not safe. This entire sub has “invest responsibly” posts slathered all over it because even the most foolhardy zealots realize that that saying you should save your life’s earnings in Bitcoin is a terrible idea. If I had $20 in a bank account in 2008, when I took it out today, it would only be worth 87% of what it was then. Inflation does hurt you over long periods of time, but this was a smooth, monotonic decay. It’s the kind of value you can quite literally bank on decades in advance. Bitcoin has no such assurances. The value of your life savings denominated in Bitcoin changes significantly every day.

- A standard of value – The fact that people’s biggest concern is how many dollars one can buy with their Bitcoin tells you everything you need to know. Nobody denominates values in Bitcoin – it would be completely useless. If I told you this car was worth 1 BTC, that means two different things on Monday vs. Friday. If I tell you it’s worth $15000, you understand.

It protects signal integrity to a degree that no other currency type can.

This is why cryptocurrency is so valuable, and why it will continue to soar

they betray their ignorance, their illiteracy and their complete blindness to the revolution that’s happening right under their feet and which will, in time, bring down the corrupt power structures of our world to create a freer, fairer society for all of us.

Nick Leeson tweets about Bitcoin futures :)

How much can I lose in the first hour of trading? https://t.co/mUWGB0sYgN

— Nick Leeson (@TheNickLeeson) December 10, 2017

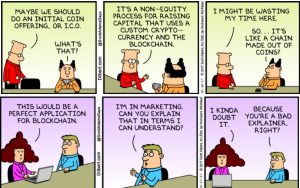

Dilbert getting on-board!

Alex and the Blockchain

£1984: does a cashless economy make for a surveillance state?

Interesting article on the potentially intrusive nature of a cashless society. Multiple that by what Google and Apple already know about us, and then add their cashless Apps in!

Intriguing footnote. If you’d bought 1 bitcoin, the only real alternative electronic cash not run by the banks, on the day of this article it would have cost you $234 US. Today, some 34 days later its market value is $361 US. Nice little 54% rise in a month. 🙂